UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

þo Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

oþ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under §240.14a-12

|

|

| CENTENNIAL RESOURCE DEVELOPMENT, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| | | | |

| (1) | Title of each class of securities to which transaction applies: |

| | | | | |

| (2) | Aggregate number of securities to which transaction applies: |

| | | | | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| (4) | Proposed maximum aggregate value of transaction: |

| | | | | |

| (5) | Total fee paid: |

| | | | | |

| | | | | |

o Fee paid previously with preliminary materials.

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| | | | |

| (1) | Amount Previously Paid: |

| | | | | |

| (2) | Form, Schedule or Registration Statement No.: |

| | | | | |

| (3) | Filing Party: |

| | | | | |

| (4) | Date Filed: |

| | | | | |

EXPLANATORY NOTE

This preliminary proxy statement is being filed because the registrant inadvertently filed its preliminary proxy statement on March 8, 2019 under the filing submission type used for definitive proxy statements (DEF 14A). This proxy statement is being filed solely to file the registrant’s preliminary proxy statement using the correct filing submission type for preliminary proxy statements (PRE 14A). Other than the inclusion of this Explanatory Note, this preliminary proxy statement is the same as the earlier filed preliminary proxy statement.

Centennial Resource Development, Inc.

1001 Seventeenth17th Street, Suite 1800

Denver, Colorado 80202

(720) 499-1400

March [20], 201919, 2020

Dear Stockholder:

You are cordially invited to attend the 20192020 annual meeting of stockholders (the “Annual Meeting”) of Centennial Resource Development, Inc., a Delaware corporation (“Centennial,(the “Company,” “we,” “us” or “our”), which will be held at 10:00 a.m., Central Time, on Wednesday, May 1, 2019, atApril 29, 2020. The Annual Meeting will be a virtual meeting of stockholders conducted online by live audio webcast. You will be able to attend the Sugar Land Marriott Town Square, 16090 City Walk, Sugar Land, TX 77479. virtual meeting, vote your shares electronically and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/CDEV2020. To participate in the virtual meeting, you will need the control number included on your Notice Regarding the Internet Availability of Proxy Materials or on your proxy card.

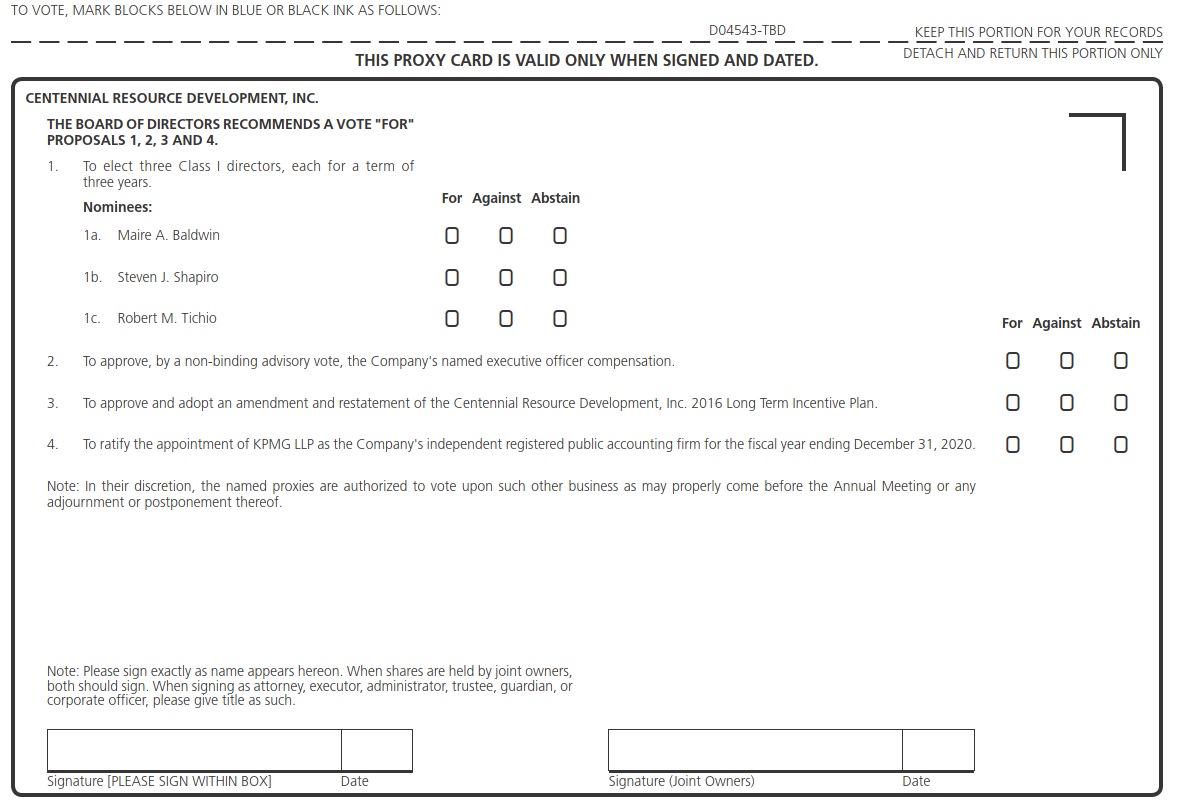

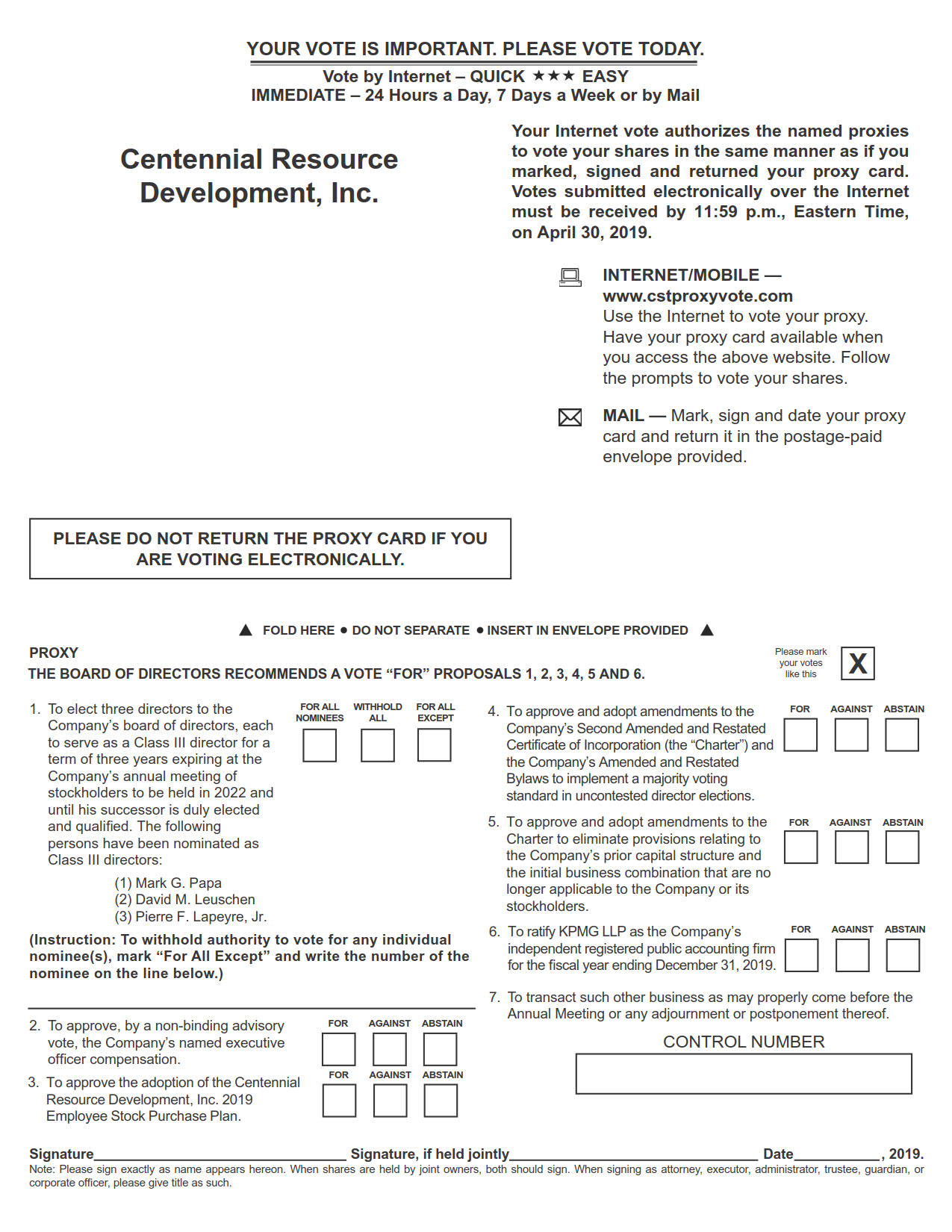

At the Annual Meeting, stockholders will be asked to (i) elect three nominees to serve on our board of directors as Class IIII directors, (ii) approve, by a non-binding advisory vote, our named executive officer compensation, (iii) approve the adoptionand adopt an amendment and restatement of the Centennial Resource Development, Inc. 2019 Employee Stock Purchase2016 Long Term Incentive Plan (iv) approve and adopt amendments to Centennial’s Second Amended(the “Amended and Restated CertificateLTIP”), which, among other items, increases the number of Incorporation (the “Charter”) and Centennial’s Amended and Restated Bylaws to implement a majority voting standard in uncontested director elections, (v) approve and adopt amendments toshares of Class A common stock authorized for issuance under the Charter to eliminate provisions relating to our prior capital structure and the initial business combination that are no longer applicable to us or our stockholders, (vi)existing 2016 Long Term Incentive Plan by 8,250,000 shares, (iv) ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20192020 and (vii)(v) act upon such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. These proposals are more fully described in our proxy statement.

On or about March [20], 2019,19, 2020, we will mail to our stockholders either a full set of paper proxy materials or a Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting (the “Notice”) containing instructions on how to access our proxy statement and our annual report for the fiscal year ended December 31, 20182019 and authorize your proxy electronically via the Internet or by telephone. If you receive a Notice, it will also contain instructions on how to receive a paper copy of the proxy materials.

It is important that your shares be represented at the Annual Meeting and voted in accordance with your wishes. Whether or not you plan to attend the meeting, we urge you to authorize your proxy as promptly as possible, either electronically via the Internet, by telephone or, if you receive paper proxy materials, by completing and returning the enclosed proxy card, so that your shares will be voted at the Annual Meeting. This will not limit your right to attend the Annual Meeting or vote in person or to attendelectronically during the Annual Meeting.

Thank you for your ongoing support.

Sincerely,

Mark G. Papa

Chief Executive Officer and Chairman of the Board

Centennial Resource Development, Inc.

1001 Seventeenth17th Street, Suite 1800

Denver, Colorado 80202

(720) 499-1400

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 1, 2019April 29, 2020

To our Stockholders:

The annual meeting of stockholders (the “Annual Meeting”) of Centennial Resource Development, Inc., a Delaware corporation (“Centennial,(the “Company,” “we,” us” or “our”), will be held at the Sugar Land Marriott Town Square, 16090 City Walk, Sugar Land, TX 77479 on Wednesday, May 1, 2019, at 10:00 a.m., Central Time on Wednesday, April 29, 2020. The Annual Meeting will be a virtual meeting of stockholders conducted online by live audio webcast. You will be able to attend the virtual meeting, vote your shares electronically and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/CDEV2020. To participate in the virtual meeting, you will need the control number included on your Notice Regarding the Internet Availability of Proxy Materials or on your proxy card.

The Annual Meeting is being held for the following purposes:

| |

| 1. | To elect three directors to our board of directors, each to serve as a Class IIII director for a term of three years expiring at our annual meeting of stockholders to be held in 20222023 and until his or her successor is duly elected and qualified. The following persons have been nominated as Class IIII directors: |

•Mark G. Papa;Maire A. Baldwin;

•David M. Leuschen;Steven J. Shapiro; and

•Pierre F. Lapeyre, Jr.;Robert M. Tichio.

| |

| 2. | To approve, by a non-binding advisory vote, our named executive officer compensation; |

| |

| 3. | To approve the adoptionand adopt an amendment and restatement of the Centennial Resource Development, Inc. 2019 Employee Stock Purchase Plan;2016 Long Term Incentive Plan (the “Amended and Restated LTIP”), which, among other items, increases the number of shares of Class A common stock authorized for issuance under the existing 2016 Long Term Incentive Plan by 8,250,000 shares; |

| |

| 4. | To approve and adopt amendments to Centennial’s Second Amended and Restated Certificate of Incorporation (the “Charter”) and Centennial’s Amended and Restated Bylaws to implement a majority voting standard in uncontested director elections; |

| |

5. | To approve and adopt amendments to the Charter to eliminate provisions relating to our prior capital structure and the initial business combination that are no longer applicable to us or our stockholders; |

| |

6. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019;2020; and |

| |

7.5. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Only stockholders of record at the close of business on March 13, 2019,11, 2020, the record date for the Annual Meeting, will be entitled to notice of and to vote at the Annual Meeting.

Whether or not you expect to be present atattend the Annual Meeting, we urge you to authorize your proxy electronically via the Internet, by telephone or, if you received paper proxy materials, by completing and returning the enclosed proxy card. Voting instructions are provided in the Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting or, if you received paper proxy materials, printed on your proxy card and included in the accompanying proxy statement. Any person giving a proxy has the power to revoke it at any time prior to the Annual Meeting, and stockholders who are present atattend the Annual Meeting may withdraw their proxies and vote in person.electronically during the Annual Meeting.

By Order of the Board of Directors,

Mark G. Papa

Chief Executive Officer and Chairman of the Board

Denver, Colorado

March [20], 201919, 2020

CENTENNIAL RESOURCE DEVELOPMENT, INC.

1001 Seventeenth17th Street, Suite 1800

Denver, Colorado 80202

PROXY STATEMENT

FOR

20192020 ANNUAL MEETING OF STOCKHOLDERS

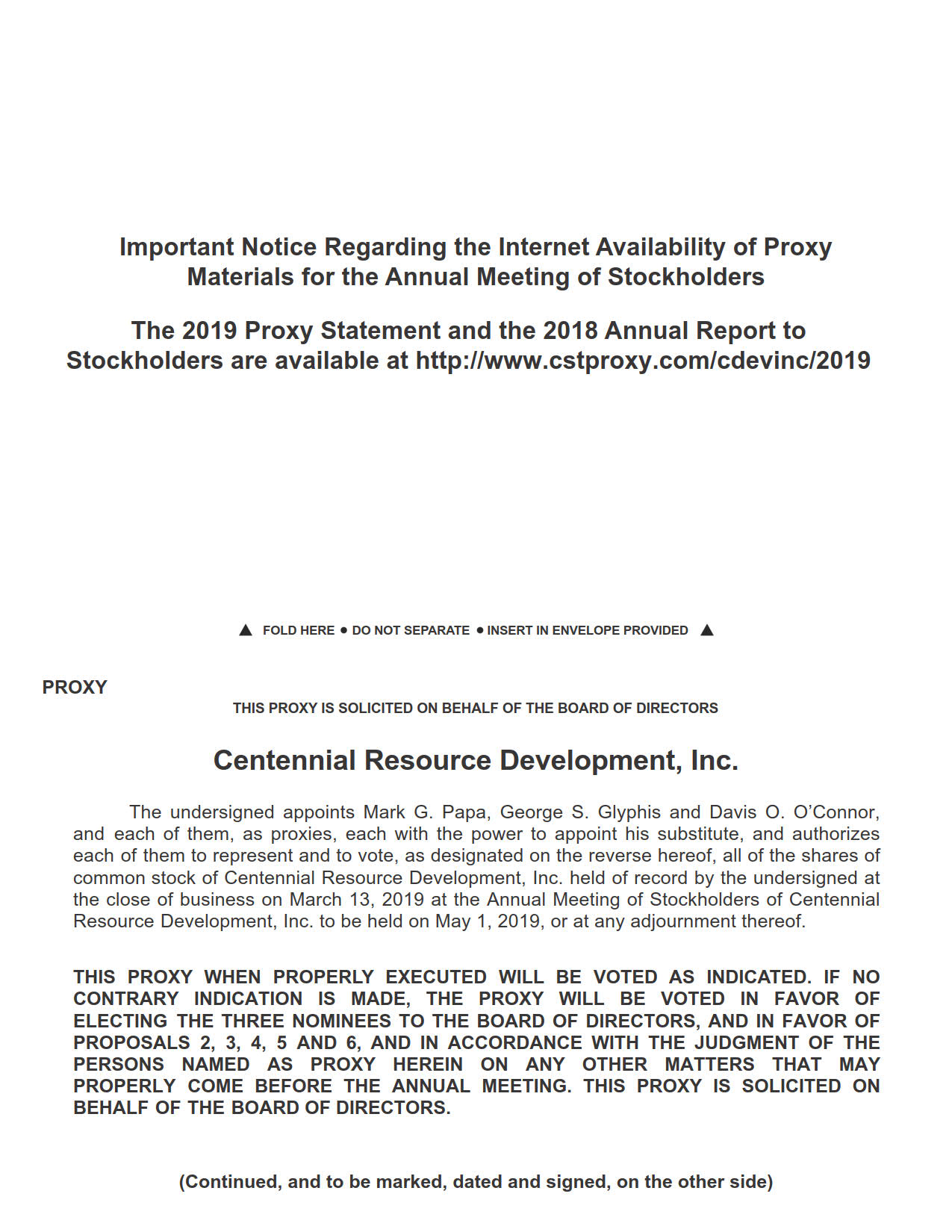

TO BE HELD ON MAY 1, 2019APRIL 29, 2020 This proxy statement is being furnished by and on behalf of the board of directors of Centennial Resource Development, Inc., a Delaware corporation (the “Company,” “we,” “us” or “our”), in connection with the solicitation of proxies to be voted at the Company’s 20192020 annual meeting of stockholders (the “Annual Meeting”). The date, time and place of the Annual Meeting are as follows:

Date: May 1, 2019April 29, 2020

Time: 10:00 a.m. (Central Time)

Place: The Sugar Land Marriott Town Square

16090 City Walk

Sugar Land, TX 77479Online at www.virtualshareholdermeeting.com/CDEV2020

At the Annual Meeting, the Company’s stockholders will be asked to:

Elect three directors to our board of directors, each to serve as a Class IIII director for a term of three years expiring at our annual meeting of stockholders to be held in 20222023 and until his or her successor is duly elected and qualified. The following persons have been nominated as Class IIII directors:

Mark G. Papa;Maire A. Baldwin;

David M. Leuschen;Steven J. Shapiro; and

Pierre F. Lapeyre, Jr.;Robert M. Tichio.

Approve, by a non-binding advisory vote, the Company’s named executive officer compensation;

Approve the adoptionand adopt an amendment and restatement of the Centennial Resource Development, Inc. 2019 Employee Stock Purchase Plan;

Approve amendments to the Company’s Second Amended2016 Long Term Incentive Plan (the “Amended and Restated CertificateLTIP”), which, among other items, increases the number of Incorporation (the “Charter”) andshares of Class A common stock authorized for issuance under the Company’s Amended and Restated Bylaws (the “Bylaws”) to implement a majority voting standard in uncontested director elections;

Approve and adopt amendments to the Charter to eliminate provisions relating to our prior capital structure and the initial business combination that are no longer applicable to us or our stockholders;existing 2016 Long Term Incentive Plan by 8,250,000 shares;

Ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019;2020; and

Transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

Our principal executive offices are located at 1001 Seventeenth17th Street, Suite 1800, Denver, Colorado 80202, and our telephone number is (720) 499-1400.

We are furnishing the proxy materials for the Annual Meeting by mailing to our stockholders either a full set of paper proxy materials or a Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting (the “Notice”). The paper proxy materials and the Notice will first be mailed to stockholders on or about March [20], 2019.19, 2020.

TABLE OF CONTENTS

|

| | | | |

| | | | | Page |

GENERAL INFORMATION ABOUT THE MEETING

| | |

| | | | |

| | Why did I receive a Notice Regarding the Internet Availability | | |

| | Why did you send me the proxy materials or the Notice? | | |

| | Can I vote my shares of Common Stock by filling out and returning the Notice? | | |

| | Who can vote? | | |

| | How is a quorum determined? | | |

| | What is the required vote for approval? | | |

| | How do I vote by proxy? | | |

| | How can I authorize my proxy online or via telephone? | | |

| | What if other matters come up at the Annual Meeting? | | |

| | Can I change my previously authorized vote? | | |

| | Can I vote in person at the Annual Meeting rather than by authorizing a proxy? | | |

| | Will my shares of Common Stock be voted if I do not provide my proxy? | | |

| | What do I do if my shares are held in “street name”? | | |

| | Who will count the votes? | | |

| | Who pays for this proxy solicitation? | | |

| | Who can help with my questions? | | |

| | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | |

| | | | |

| | |

| | | | |

| | | | |

| | | | |

| | |

| | |

| | | | |

| | | | |

| | | | |

GENERAL INFORMATION ABOUT THE MEETING

In this section of the proxy statement, we answer some common questions regarding the Annual Meeting and the voting of shares of our Class A Common Stock, par value $0.0001 per share (the “Class A Common Stock”) and Class C Common Stock, par value $0.0001 per share (the “Class C Common Stock” and, together with the Class A Common Stock, the “Common Stock”), at the Annual Meeting.

Where and when will the Annual Meeting be held?

The date, time and place of the Annual Meeting are as follows:

May 1, 2019

will be held at 10:00 a.m. (Central Time), Central Time on Wednesday, April 29, 2020. The Annual Meeting will be a virtual meeting of stockholders conducted online by live audio webcast. There will not be any physical, in-person meeting. You will be able to attend the virtual meeting by visiting www.virtualshareholdermeeting.com/CDEV2020. To participate in the virtual meeting, you will need the control number included on your Notice Regarding the Internet Availability of Proxy Materials or on your proxy card.

The Sugar Land Marriott Town Square

16090 City Walk

Sugar Land, TX 77479

Why did I receive a Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting in the mail instead of a paper copy of the proxy materials?

The United States Securities and Exchange Commission (the “SEC”) has approved rules (the “e-proxy rules”) allowing companies to furnish proxy materials, including this proxy statement and our annual report for the fiscal year ended December 31, 2018,2019, to our stockholders by providing access to such documents on the Internet instead of mailing paper copies. We believe these e-proxy rules provide a convenient and quick way in which our stockholders can access the proxy materials and vote their shares of Common Stock, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. Accordingly, certain of our stockholders will receive a Notice Regarding the Internet Availability of Proxy Materials for the Annual Meeting (the “Notice”) and will not receive paper copies of the proxy materials unless they request them. Instead, the Notice will provide such stockholders with notice of the Annual Meeting and will also provide instructions regarding how such stockholders can access and review all of the proxy materials on the Internet. The Notice also provides instructions as to how you may submit your proxy electronically via the Internet or by telephone. If you received the Notice and you would instead prefer to receive a paper or electronic copy of the proxy materials, you should follow the instructions for requesting such materials that are provided in the Notice. Any request to receive proxy materials by mail or email will remain in effect until you revoke it.

Why did you send me the proxy materials or the Notice?

We sent you the proxy materials or the Notice because we are holding our Annual Meeting and our board of directors (the “Board”) is asking for your proxy to vote your shares of Common Stock at the Annual Meeting. We have summarized information in this proxy statement that you should consider in deciding how to vote at the Annual Meeting.

Can I vote my shares of Common Stock by filling out and returning the Notice?

No. The Notice identifies the items to be voted on at the Annual Meeting, but you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to authorize your proxy electronically via the Internet, by telephone or by requesting and returning a paper proxy card, or you may vote your shares of Common Stock by submitting aan electronic ballot in person at the meeting.

Who can vote?

You can vote your shares of Common Stock if our records show that you were the owner of the shares as of the close of business on March 13, 2019,11, 2020, the record date for determining the stockholders who are entitled to vote at the Annual Meeting. As of March 13, 2019,11, 2020, there were a total of [264,394,082]276,020,471 shares of Class A Common Stock and [12,003,183]1,034,119 shares of Class C Common Stock outstanding and entitled to vote at the Annual Meeting. You get one vote for each share of Common Stock that you own.

How is a quorum determined?

We will hold the Annual Meeting ifof stockholders representing the required quorum of shares of Common Stock entitled to vote authorize their proxy online or telephonically, sign and return their proxy cards or attend the Annual Meeting. The presence in personvia live webcast or by proxy of a majority of the shares of Common Stock entitled to vote at the Annual Meeting constitutes a quorum. If you authorize your proxy online or telephonically or sign and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to indicate your vote on the proxy card.

What is the required vote for approval?

The election of each of our Class IIII director nominees requires the vote of a pluralitymajority of the votes cast by the stockholders present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal. If you withhold votes for purposes of the vote on the election of directors, your withheld votesAbstentions and broker non-votes will not be counted as votes cast and, therefore, will not have noan effect on the result of such vote. Broker non-votes also have no effect on the outcomeresults of the vote.election of directors. We have adopted a director resignation policy whereby an incumbent director who fails to receive a majority of the votes cast during an uncontested election may be required by the Board to resign. See “Corporate Governance—Majority Voting in Director Elections” for additional information regarding the majority voting standard for uncontested director elections and our director resignation policy.

The approval by a non-binding advisory vote of our named executive officer compensation, the approval of theand adoption of the Centennial Resource Development, Inc. 2019 Employee Stock Purchase PlanAmended and Restated LTIP and the ratification of the appointment of KPMG LLP as our independent registered public accounting firm require the vote of a majority of the votes cast by the stockholders present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal. If you abstain for purposes of these proposals, your abstention will not be counted as a vote cast and, therefore, will not have an effect on the results of such vote. For the approval and adoption of the Centennial Resource Development, Inc. 2019 Employee Stock Purchase PlanAmended and Restated LTIP and the approval on an advisory basis of our named executive officer compensation, broker non-votes will have no effect on the outcome of the vote. However, the rules of the NASDAQ Capital Market (the “NASDAQ”) permit brokers to vote uninstructed shares at their discretion regarding the ratification of the appointment of KPMG LLP as our independent registered public accounting firm, so there will be no broker non-votes on the proposal.

The two proposals that contain proposed amendments to the Company’s Charter and Bylaws require a vote, whether present in person or represented by proxy at the Annual Meeting, of the majority of outstanding shares of Common Stock entitled to vote on the proposal. If you abstain for purposes of these proposals, your abstention will be counted as a vote against the proposal. Broker non-votes will have no effect on the outcome of the vote for these proposals.

How do I vote by proxy?

Follow the instructions on the Notice or the proxy card to authorize a proxy to vote your shares of Common Stock at the Annual Meeting electronically via the Internet or by telephone or, if you received paper proxy materials, by completing and returning the proxy card. The individuals named and designated as proxies will vote your shares of Common Stock as you instruct. You have the following choices in voting your shares of Common Stock:

You may vote on each proposal, in which case your shares will be voted in accordance with your choices.

In voting on the election of Class IIII directors, you may either vote “FOR” or “AGAINST” each director or withhold your vote on any or all of the directors.director.

You may abstain from voting on the proposal (i) to elect our Class I director nominees, (ii) to approve on an advisory basis our named executive officer compensation, (ii)(iii) to approve the adoption of the Centennial Resource Development, Inc. 2019 Employee Stock Purchase PlanAmended and (iii)Restated LTIP and (iv) to ratify the appointment of KPMG LLP as our independent registered public accounting firm, in which case no vote will be recorded with respect to the proposal.

You may abstain from voting on the two proposals that contain proposed amendments to the Company’s Charter and Bylaws, in which case your vote will be counted as a vote against the proposal.

You may return a signed proxy card without indicating your vote on any matter, in which case the designated proxies will vote to (i) elect each Class IIII director nominee, (ii) approve on an advisory basis our named executive officer compensation, (iii) approve the adoption of the Centennial Resource Development, Inc. 2019 Employee Stock Purchase Plan,Amended and Restated LTIP and (iv) approve the two proposals that contain proposed amendments to the Company’s Charter and Bylaws and (v) ratify the appointment of KPMG LLP as our independent registered public accounting firm.

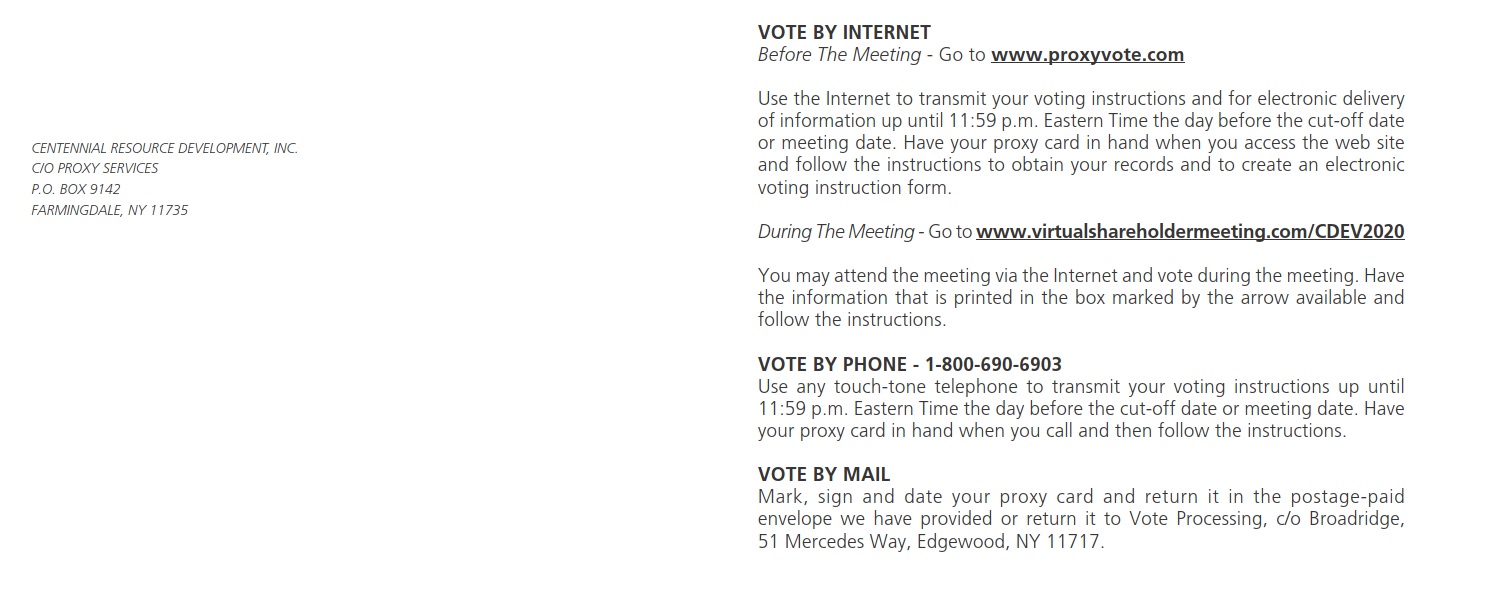

How can I authorize my proxy online or via telephone?

In order to authorize your proxy online or via telephone, go to www.cstproxyvote.comwww.proxyvote.com or call the toll-free number reflected on the Notice, and follow the instructions. If your shares of Common Stock are held in the name of your broker, a bank or other nominee in “street name,” that party will give you instructions for voting your shares. Please have your Notice in hand when accessing the site, as it contains a control number required for access. You can authorize your proxy electronically via the Internet or by telephone at any time prior to 11:59 p.m., Eastern Time, on April 30, 2019,28, 2020, the day before the Annual Meeting.

If you received paper proxy materials, you may also refer to the enclosed proxy card for instructions. If you choose not to authorize your proxy electronically, please complete and return the paper proxy card in the pre-addressed, postage-paid envelope provided.

What if other matters come up at the Annual Meeting?

As of the date of this proxy statement, the only matters we know of that will be voted on at the Annual Meeting are the proposals we have described herein: (i) the election of three Class IIII directors, (ii) the approval on an advisory basis of our named executive officer compensation, (iii) the approval of the adoption of the Centennial Resource Development, Inc. 2019 Employee Stock Purchase Plan,Amended and Restated LTIP; and (iv) the approval and adoption of amendments to the Company’s Charter and Bylaws to implement a majority voting standard in uncontested director elections, (v) the approval and adoption of amendments to the Charter to eliminate provisions relating to our prior capital structure and the initial business combination that are no longer applicable to us or our stockholders; and (vi) the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019.2020. If other matters are properly presented at the Annual Meeting, the designated proxies will vote your shares of Common Stock at their discretion.

Can I change my previously authorized vote?

Yes, you can change your vote at any time before the vote on a proposal either by executing or authorizing, dating and delivering to us a new proxy electronically via the Internet, by telephone or by mail at any time prior to 11:59 p.m., Eastern Time, on April 30, 2019,28, 2020, the day before the Annual Meeting, by giving us a written notice revoking your proxy card or by attending the Annual Meeting and electronically voting your shares of Common Stock in person.during the Annual Meeting. Your attendance at the Annual Meeting will not, by itself, revoke a proxy previously given by you. We will honor the latest dated proxy.

Proxy revocation notices or new proxy cards should be sent to Centennial Resource Development, Inc., 1001 Seventeenth17th Street, Suite 1800, Denver, Colorado, 80202, Attention: General Counsel.

Can I vote in person atduring the Annual Meeting rather than by authorizing a proxy?

You can virtually attend the Annual Meeting and electronically vote your shares of Common Stock in person;during the Annual Meeting; however, we encourage you to authorize your proxy to ensure that your vote is counted. Authorizing your proxy electronically or telephonically, or submitting a proxy card, will not prevent you from later attending the Annual Meeting and electronically voting your shares of Common Stock in person.during the Annual Meeting.

Will my shares of Common Stock be voted if I do not provide my proxy?

Depending on the proposal, your shares of Common Stock may be voted if they are held in the name of a brokerage firm, even if you do not provide the brokerage firm with voting instructions. Brokerage firms have the authority under the NASDAQ rules to cast votes on certain “routine” matters if they do not receive instructions from their customers. The proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm is considered a “routine” matter for which brokerage firms may vote shares without receiving voting instructions.

Brokerage firms do not have the authority under the NASDAQ rules to vote on non-routine matters, which include the election of directors, the approval on an advisory basis of our named executive officer compensation and the approval of the adoption of the Centennial Resource Development, Inc. 2019 Employee Stock Purchase PlanAmended and the approval of the two proposals that contain proposed amendments to the Company’s Charter and Bylaws.Restated LTIP. If you do not provide the brokerage firm with voting instructions on these proposals, your shares will not be voted and will result in “broker non-votes.” Broker non-votes will be considered present for the purpose of determining whether we have a quorum; however, such broker non-votes will not have an effect on the election of directors, the approval on an advisory basis of our named executive officer compensation or the approval of the adoption of the Centennial Resource Development, Inc. 2019 Employee Stock Purchase Plan or the approvalAmended and adoption of the proposed amendments to the Company’s Charter and Bylaws described in Proposals 4 and 5.Restated LTIP.

What do I do if my shares are held in ���street“street name”?

If your shares of Common Stock are held in the name of your broker, a bank or other nominee in “street name,” that party will give you instructions for voting your shares. If your shares of Common Stock are held in “street name” and you would like to electronically vote your shares in person atduring the Annual Meeting, you must contact your broker, bank or other nominee to obtain a proxy form from the record holder of your shares.

Who will count the votes?

RepresentativesA representative of Continental Stock Transfer & Trust CompanyBroadridge Financial Solutions, Inc. will count the votes and will serve as the independent inspector of election.

Who pays for this proxy solicitation?

We do. The Company has engaged Morrow Sodali, to assist in the solicitation of proxies for the Annual Meeting. The Company has agreed to pay Morrow Sodali a fee of $6,500, plus disbursements. The Company will reimburse Morrow Sodali for reasonable out-of-pocket expenses and will indemnify Morrow Sodali and its affiliates against certain claims, liabilities, losses, damages and expenses. The Company will also reimburse banks, brokers and other custodians, nominees and fiduciaries representing beneficial owners of shares of Common Stock for their expenses in forwarding soliciting materials to beneficial owners of shares of Common Stock and in obtaining voting instructions from those owners. In addition to sending you these materials, some of our employees or agents may contact you by telephone, by mail or in person. None of our employees will receive any extra compensation for providing those services.

Who can help with my questions?

If you have additional questions about this proxy statement or the Annual Meeting or would like to receive additional copies, without charge, of this document or our annual report for the fiscal year ended December 31, 2018,2019, please contact:

Centennial Resource Development, Inc.

1001 Seventeenth17th Street, Suite 1800

Denver, Colorado, 80202

Attention: General Counsel

If you have any questions or need assistance voting your shares you may also contact our proxy solicitor at:

Morrow Sodali LLC

470 West Avenue, 3rd Floor

Stamford, CT 06902

Banks and Brokerage Firms, please call (203) 658-9400

Stockholders, please call toll free (800) 662-5200

PROPOSAL 1

ELECTION OF DIRECTORS

Director Nomination Process

The Nominating and Corporate Governance Committee of our Board (the “N&CG Committee”) identifies, evaluates and recommends to our Board director candidates with the goal of identifying individuals with a high level of personal and professional integrity, strong ethics and values and the ability to make mature business judgments. In evaluating director candidates, the N&CG Committee may also consider certain other criteria as set forth in our Corporate Governance Guidelines, including, among other things:

the candidate’s experience in corporate management, such as serving as an officer or former officer of a publicly held company;

the candidate’s experience as a board member of another publicly held company;

the candidate’s professional and academic experience relevant to our industry;

the strength of the candidate’s leadership skills;

the candidate’s experience in finance and accounting and/or executive compensation practices;

the overall diversity of the Board; and

whether the candidate has the time required for preparation, participation and attendance at Board meetings and committee meetings, if applicable.

The N&CG Committee and the Board monitor the mix of specific experience, qualification and skills of our directors in order to ensure that the Board, as a whole, has the necessary tools to perform its oversight function effectively. Generally, the N&CG Committee identifies candidates through the personal, business and organizational contacts of the directors and management, but the N&CG Committee may also engage an executive search firm to assist in the process.

Our Corporate Governance Guidelines requires that each nominee for director sign and deliver to the Board an irrevocable letter of resignation that becomes effective if (a) the nominee does not receive a majority of the votes cast in an uncontested election, and (b) the Board decides to accept the resignation. The Board has received such conditional letters of resignation from each of the nominees named in Proposal 1.

Board Structure

There are currently nine directors on our Board, and eight of ourthe directors are divided into three classes, with two directors in Class I and three directors in each of Class II and Class III.equal classes. The terms of office of the three Class IIII directors will expire at the Annual Meeting. One additionalEach nominee is currently a director, isincluding Steven J. Shapiro, who was appointed by the Board on October 17, 2019 (after the date of our 2019 annual meeting of stockholders). Other than Mr. Shapiro, all nominees were previously elected each yearto the Board by theour stockholders. The holder of our Series A Preferred Stock, par value $0.0001 per share, has the right to servenominate and elect one additional director to our Board but has declined to do so since May 2019, when the director previously nominated and elected by such holder resigned.

The following table provides a snapshot of the current members of the Board and its committees. |

| | | | | | | | | | | | | | |

| | | | | | | | | | | Committee Memberships |

| Name | | Director Class | | Term Expires | | Director Since | | Independent | | Audit | | Comp. | | N&CG |

| Maire A. Baldwin* | | I | | 2020 | | 2016 | | ü | | ü | | þ | | ü |

| Steven J. Shapiro | | I | | 2020 | | 2019 | | ü | | ü | | ü | | |

| Robert M. Tichio | | I | | 2020 | | 2016 | | | | | | | | |

| Karl E. Bandtel | | II | | 2021 | | 2016 | | ü | | ü | | | | þ |

| Matthew G. Hyde | | II | | 2021 | | 2018 | | ü | | | | ü | | ü |

| Jeffrey H. Tepper | | II | | 2021 | | 2016 | | ü | | þ | | ü | | |

| Pierre F. Lapeyre, Jr. | | III | | 2022 | | 2016 | | | | | | | | |

| David M. Leuschen | | III | | 2022 | | 2016 | | | | | | | | |

| Mark G. Papa** | | III | | 2022 | | 2015 | | | | | | | | |

* = Lead Independent Director

** = Chairman of the Board; Mr. Papa intends to retire effective May 31, 2020 as discussed below in “Corporate Governance—Leadership Transition.”

ü= Independent Director / Committee Member

þ= Committee Chair

Summary of Director Qualifications

The members of the Board have a diversity of experience and a wide variety of backgrounds, skills, qualifications and viewpoints that strengthen their ability to carry out their oversight role on behalf of our stockholders. The following matrix highlights key qualifications, skills and attributes each director brings to the Board. The lack of a mark for a one-year term expiring atparticular item does not mean the next annual meetingdirector does not possess that qualification or expertise. However, a mark indicates a specific area of focus or expertise that the director brings to our stockholders.Board. More details on each director’s qualifications, skills and expertise are included in the director biographies on the following pages.

|

| | | | | | | | | | | | | | | | | | | | |

| Name | | Accounting / Financial Oversight | | Business Development / M&A | | ESG Oversight | | Executive Leadership | | E&P Industry | | Finance / Capital Markets | | Investor Relations | | Marketing / Midstream | | Public Company Board | | Strategic Planning / Risk Management |

| Maire A. Baldwin | | ü | | | | | | ü | | ü | | ü | | ü | | | | | | |

| Karl E. Bandtel | | ü | | | | | | | | ü | | ü | | | | | | | | |

| Matthew G. Hyde | | | | ü | | | | ü | | ü | | | | | | | | | | ü |

| Pierre F. Lapeyre, Jr. | | ü | | ü | | | | | | ü | | ü | | | | ü | | ü | | ü |

| David M. Leuschen | | | | ü | | ü | | | | ü | | ü | | | | ü | | ü | | |

| Mark G. Papa | | ü | | ü | | ü | | ü | | ü | | | | ü | | ü | | ü | | ü |

| Steven J. Shapiro | | ü | | ü | | ü | | ü | | ü | | ü | | ü | | ü | | ü | | ü |

| Jeffrey H. Tepper | | ü | | ü | | ü | | | | | | ü | | | | | | ü | | ü |

| Robert M. Tichio | | ü | | ü | | ü | | | | ü | | ü | | | | | | ü | | ü |

Class IIII Election

The three nominees for election as Class IIII directors are listed below. If elected, the nominees for election as Class IIII directors will serve on our Board for a term of three years expiring at our annual meeting of stockholders in 20222023 and until their respective successors are duly elected and qualified. Each of the nominees currently serves on our Board.

Class IIII Nominees

The Class IIII nominees are as follows:

|

| | | | |

| Director | | Age, Principal Occupation, Business Experience, Other Directorships Held and Director Qualifications | | Director Since |

Mark G. PapaMaire A. Baldwin

(Class III)I) | | Mark G. Papa,Maire A. Baldwin, age 72,54, has served as our Chief Executive Officera director since October 2016 and Chairman ofas the BoardLead Independent Director since November 2015. Mr. Papa is also2018. Ms. Baldwin was employed as an advisorAdvisor to Riverstone Holdings, LLC, a private equity firm specializing in energy investments (together with its affiliates, “Riverstone”). We currently anticipate that Mr. Papa will spend approximately 90% of his working time providing services to us as our Chairman and Chief Executive Officer and approximately 10% of his working time providing services to Riverstone on matters unrelated to the Company. Prior to joining Riverstone in February 2015, Mr. Papa was Chairman and CEO of EOG Resources, Inc. (NYSE: EOG), an independent U.S. oil and gas company (“EOG”), from August 1999 to December 2013. Mr. Papa served as a member of EOG’s board of directors from August 1999 until December 2014. Mr. Papa worked at EOG for 32 years in various management positions. Mr. Papa was retired from December 2013 through February 2015. Prior to joining EOG, Mr. Papa worked at Conoco Inc. for 13 years in various engineering and management positions. Mr. Papa has also served on the board of Schlumberger Limited (NYSE: SLB), an international oilfield services company, since October 2018 and Casa de Esperanza, a non-profit organization serving children in crisis situations, since November 2006. Mr. Papa previously served on the board of Oil States Industries (NYSE: OIS), an international oilfield services company, from February 2001 to August 2018. In February 2010 and 2013, the Harvard Business Review cited Mr. Papa as one of the 100 Best Performing CEOs in the World; both times Mr. Papa was the highest ranked Global Energy CEO. Additionally, Institutional Investor magazine repeatedly ranked him as the Top Independent E&P CEO. He received his B.S. in petroleum engineering from the University of Pittsburgh and an MBA from the University of Houston.

We believe Mr. Papa’s significant experience in the energy industry and his deep understanding of the Company and its assets make him well qualified to serve as the Chairman of our Board. Through his current role as our Chief Executive Officer and Chairman, and his prior experience with EOG and other exploration and production companies, Mr. Papa has established himself in the industry as a proven leader with a strong understanding of exploration and production techniques, macro conditions in the energy industry, as well as the operational, strategic, financial, risk and compliance issues facing a publicly traded company in the upstream oil and gas industry.

| | 2015 |

|

| | | | |

David M. Leuschen

(Class III)

| | David M. Leuschen, age 67, has served as a director since October 2016. Mr. Leuschen is a Founder of Riverstone and has been a Senior Managing Director since 2000. Prior to founding Riverstone, Mr. Leuschen was a Partner and Managing Director at Goldman Sachs and founder and head of the Goldman Sachs Global Energy and Power Group. Mr. Leuschen joined Goldman Sachs in 1977, became head of the Global Energy and Power Group in 1985, became a Partner of that firm in 1986 and remained with Goldman Sachs until leaving to found Riverstone in 2000. Mr. Leuschen also served as Chairman of the Goldman Sachs Energy Investment Committee, where he was responsible for screening potential investments by Goldman Sachs in the energy and power industries. Mr. Leuschen has served as a non-executive board member of Riverstone Energy Limited (LSE: REL) (“REL”) since May 2013 and serves on the boards of directors or equivalent bodies of a number of private Riverstone portfolio companies and their affiliates. Mr. Leuschen is currently a director of Alta Mesa Resources, Inc. (NASDAQ: AMR), a position he has held since February 2018. In 2007, Mr. Leuschen, along with Riverstone and The Carlyle Group (“Carlyle”), became the subject of an industry-wide inquiry by the Office of the Attorney General of the State of New York (the “Attorney General”) relating to the use of placement agents in connection with investments by the New York State Common Retirement Fund (“NYCRF”) in certain funds, including funds that were jointly developed by Riverstone and Carlyle. In June 2009, Riverstone entered into an Assurance of Discontinuance with the Attorney General to resolve the matter and agreed to make a restitution payment of $30 million to the New York State Office of the Attorney General for the benefit of NYCRF. Mr. Leuschen also entered into an Assurance of Discontinuance with the Attorney General in December 2009 and agreed that Riverstone and/or Mr. Leuschen would make a restitution payment of $20 million to the New York State Office of the Attorney General for the benefit of NYCRF. Mr. Leuschen received an MBA from Dartmouth’s Amos Tuck School of Business and an A.B. degree from Dartmouth College.

As a founder of Riverstone, Mr. Leuschen has overseen investments in, and the operations of, various companies operating in the energy and power industries. In connection with that role and his prior experience at Goldman Sachs, Mr. Leuschen has a deep understanding of the energy and power industries and has extensive experience with capital markets and other financing transactions. Mr. Leuschen also serves as a director on the boards of various other energy and power companies, which we believe further enhances his understanding of the industry and perspective on best practices relating to corporate governance, corporate responsibility, management and capital markets transactions. For these reasons, among others, we believe Mr. Leuschen is qualified to serve as a director.

| | 2016 |

|

| | | | |

Pierre F. Lapeyre, Jr.

(Class III)

| | Pierre F. Lapeyre, Jr., age 56, has served as a director since October 2016. Mr. Lapeyre is a Founder of Riverstone and has been a Partner/Senior Managing Director since 2000. Prior to founding Riverstone, Mr. Lapeyre was a Managing Director of Goldman Sachs in its Global Energy and Power Group. Mr. Lapeyre joined Goldman Sachs in 1986 and spent his 14-year investment banking career focused on energy and power, particularly the midstream, upstream and energy service sectors. Mr. Lapeyre has served as a non-executive board member of REL since May 2013 and serves on the boards of directors or equivalent bodies of a number of public and private Riverstone portfolio companies and their affiliates. Mr. Lapeyre is currently a director of Alta Mesa Resources, Inc. (NASDAQ: AMR), a position he has held since February 2018. He has an MBA from the University of North Carolina at Chapel Hill and a B.S. in Finance and Economics from the University of Kentucky.

We believe Mr. Lapeyre is qualified to serve on our Board due to his extensive financing, mergers and acquisitions and investing experience in the energy and power industries. Mr. Lapeyre has a deep understanding of the energy and power industries arising from his experience as a Founder and Managing Director at Riverstone and prior experience at Goldman Sachs. Furthermore, as a result of Mr. Lapeyre’s service on the boards of various energy and power companies, he is able to share best practices relating to transactions, risk oversight, shareholder engagement, corporate governance, corporate responsibility and management.

| | 2016 |

Vote Required; Recommendation

The election of a director to the Board requires the affirmative vote of a plurality of the votes cast at the Annual Meeting.

OUR BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE CLASS III DIRECTOR NOMINEES NAMED ABOVE.

Continuing Directors

The five Class I and Class II directors whose terms will continue after the Annual Meeting and will expire at our 2020 (Class I) or 2021 (Class II) annual meeting of stockholders, as well as the director nominated for election at the Annual Meeting by the holder of our Series A Preferred Stock, are listed below.

|

| | | | |

Director | | Age, Principal Occupation, Business Experience, Other Directorships Held and Director Qualifications | | Director Since |

Maire A. Baldwin

(Class I)

| | Maire A. Baldwin, age 53, has served as a director since October 2016. Ms. Baldwin was employed as an Advisor to EOG, from March 2015 until April 2016. Prior to that, she was employed at EOGserved as Vice President Investor Relations at EOG from 1996 to 2014. Ms. Baldwin has served as a director of the Houston Parks Board since 2011, a non-profit dedicated to developing parks and green space to the greater Houston area where she serves on several committees. She is co-founder of Pursuit, a non-profit dedicated to raising funds and awareness of adults with intellectual and developmental disabilities. Ms. Baldwin has an MBA from the Universitya Master of Texas at AustinBusiness Administration and a B.A.Bachelor of Arts in Economics from the University of Texas at Austin.We believe Ms. Baldwin is qualified to serve on our Board due to her extensive experience in the energy industry. From her executive experience with EOG, Ms. Baldwin has a deep understanding of the oil and gas industry generally and investor relations issues specifically, which we believe gives her an important insight into best practices relating to shareholder engagement and an understanding of the investment community’s expectations for public companies in our industry. |

Steven J. Shapiro (Class I) | | Steven J. Shapiro, age 68, has served as a director since October 2019. If Mr. Shapiro is elected at the Annual Meeting, he will continue to serve in his current role as an independent director and, following the retirement of Mark G. Papa, will become the Chairman of the Board, effective June 1, 2020. For more information on the previously announced leadership transition, see “Corporate Governance-Leadership Transition” below.

Mr. Shapiro is a Senior Advisor to Outfitter Energy Capital, a private equity group focused on the energy industry, a position he has held since December 2016. From 2006 through December 2016, Mr. Shapiro was a Senior Advisor to TPH Partners, the legacy private equity business of Tudor, Pickering, Holt & Co. From 2000 to 2006, Mr. Shapiro held various leadership positions at Burlington Resources Inc. (“Burlington Resources”), an oil and gas exploration and production company, including Executive Vice President of Finance and Corporate Development and Executive Vice President and Chief Financial Officer. During his tenure at Burlington Resources, Mr. Shapiro also served as a member of the Office of the Chairman, the executive group responsible for setting the strategic direction of the company, and a member of the Board of Directors, positions he assumed in 2004. From 1993 to 2000, Mr. Shapiro served as Senior Vice President, Chief Financial Officer and Director at Vastar Resources, Inc. (“Vastar”), an oil and gas exploration and production company. In connection with that role, he also served on the Board of Directors of Southern Company Energy Marketing L.P. (“Southern Company”), a joint venture entity between Vastar and Southern Company focused on marketing electricity, natural gas and other energy commodities. Previously, Mr. Shapiro spent 16 years with Atlantic Richfield Company (“ARCO”), a global oil and gas company, beginning as a planning analyst in 1977 and later holding a variety of positions in ARCO’s coal and minerals businesses, including Vice President of Finance for ARCO Coal, Assistant Treasurer and Vice President for Corporate Planning for ARCO and President for ARCO Coal Australia.

Mr. Shapiro is currently a Director of Elk Meadows Resources, LLC, a private oil and gas exploration and production company, a position he has held since 2013. Mr. Shapiro also previously served from 2004 to January 2019 as a Director of Barrick Gold Corporation, a gold mining company (Nasdaq: GOLD); from 2010 to 2017 as Chairman of GeoSynFuels, LLC, a private biofuels company; from 2006 to 2012 as a Director of El Paso Corporation, an oil and gas exploration and production company; and from 2010 to 2012 as a Director of Asia Resource Minerals PLC, a coal exploration and mining company. Mr. Shapiro holds an undergraduate degree in Industrial Economics from Union College and a Master of Business Administration from Harvard University.

We believe Mr. Shapiro is qualified to serve on our Board and become the Chairman of the Board on June 1, 2020 due to his extensive industry experience. From his executive experience with Burlington Resources, Mr. Shapiro has significant oil and gas operating experience and knowledge of the complex financial issues that public companies face. Mr. Shapiro has also served on the Board of Directors of other publicly traded companies, and we believe his knowledge and experience in this area will further strengthen our Board.

|

|

| | |

| Director | | Age, Principal Occupation, Business Experience, Other Directorships Held and Director Qualifications |

Robert M. Tichio (Class I)

| | Robert M. Tichio, age 41,42, has served as a director since October 2016. Mr. Tichio is a Partner of Riverstone and joined Riverstone in 2006. Prior to joining Riverstone, Mr. Tichio was in the Principal Investment Area of Goldman Sachs, which manages the firm’s private corporate equity investments. Mr. Tichio began his career at J.P. Morgan in the Mergers & Acquisitions group where he concentrated on assignments that included public company combinations, asset sales, takeover defenses and leveraged buyouts. In addition to serving on the boards of a number of Riverstone portfolio companies and their affiliates, Mr. Tichio has been a director of EP Energy Corporation since September 2013, Talos Energy Inc. (NYSE: TALO) since April 2012 and Pipestone Energy Corp., a Canadian publicly traded company, since January 2019. Mr. Tichio previously served as a member of the board of directors of Gibson Energy (TSE:GEI) from 2008 to 2013; Midstates Petroleum Company, Inc. from 2012 to 2015; and, Northern Blizzard Inc. from 20102011 to 2017. He holds an MBA from Harvarda Master of Business SchoolAdministration and a bachelor’s degreeBachelor of Arts from Dartmouth College. We believe Mr. Tichio is qualified to serve on our Board due to his extensive private equitycapital markets and mergers and acquisitions experience. Mr. Tichio also serves as a director on the boards of other energy companies, which we believe further enhances his understanding of the industry and perspective on best practices relating to corporate governance, management and capital markets transactions. |

Vote Required; Recommendation

The election of each of our Class I director nominees requires the vote of a majority of the votes cast at the Annual Meeting, which means the number of votes cast “FOR” such nominee exceeds the number of votes cast “AGAINST” such nominee. Abstentions and broker non-votes will not be counted as votes cast and, therefore, will not have an effect on the outcome of the election of directors.

The Company has adopted a director resignation policy whereby an incumbent director who fails to receive a majority of the votes cast during an uncontested election may be required by the Board to resign. See “Corporate Governance—Majority Voting in Director Elections” for additional information regarding the majority voting standard for uncontested director elections and our director resignation policy.

OUR BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE CLASS I DIRECTOR NOMINEES NAMED ABOVE.

Continuing Directors

The six Class II and Class III directors whose terms will continue after the Annual Meeting and will expire at our 2021 (Class II) or 2022 (Class III) annual meeting of stockholders are listed below.

|

| | |

| Director | | 2016Age, Principal Occupation, Business Experience, Other Directorships Held and Director Qualifications |

Karl E. Bandtel (Class II) | | Karl E. Bandtel, age 52,53, has served as a director since October 2016. Mr. Bandtel was a Partner at Wellington Management Company, where he managed energy portfolios, from 1997 until June 30, 2016, when he retired. He holds a master’s degree in businessMaster of Business Administration and a Bachelor of Business Administration from the University of Wisconsin-Madison and a bachelor’s degree from the University of Wisconsin-Madison.

We believe Mr. Bandtel is qualified to serve on our Board due to his extensive experience in evaluating and investing in energy companies, both public and private, and to his executive management skills developed as part of his career with Wellington Management Company. |

|

| | |

| Director | | 2016Age, Principal Occupation, Business Experience, Other Directorships Held and Director Qualifications |

Matthew G. Hyde (Class II) | | Matthew G. Hyde, age 63,64, has served as a director since January 2018. Previously, Mr. Hyde was Senior Vice President of Exploration at Concho Resources Inc. (NYSE: CXO) (“Concho”) from 2010 to 2016. After leaving Concho, Mr. Hyde was retired until joining our Board in January 2018. From 2008 to 2010, Mr. Hyde served as Concho’s Vice President of Exploration and Land. From 2001 to 2007, Mr. Hyde was an Asset Manager of Oxy Permian, a business unit of Occidental Petroleum Corporation (NYSE: OXY). Mr. Hyde served as President and General Manager of Occidental Petroleum Corporation’s international business unit in Oman from 1998 to 2001. Prior to that role, Mr. Hyde served in a variety of domestic and international exploration positions for Occidental Petroleum Corporation, including Regional Exploration Manager responsible for Latin American exploration activities. From 2008 to 2012, Mr. Hyde served in various leadership positions, including the Executive Committee and Chairman of the Board, for the New Mexico Oil & Gas Association (NMOGA), which promotes the safe and environmentally responsible development of oil and natural gas resources in New Mexico. Mr. Hyde has also served as a director of privately held Birch Permian Holdings, Inc. since April 2018. He is a graduate of the University of Vermont and the University of Massachusetts where he obtained Bachelor of Arts and Master of Science degrees, respectively, in Geology. Mr. Hyde also holds a Master of Business Administration degree from the University of California Los Angeles. We believe Mr. Hyde is qualified to serve on our Board due to his extensive management and operational experience in the upstream oil and gas industry, including in the Permian and Delaware Basins. | | 2018 |

|

| | | | |

Jeffrey H. Tepper (Class II) | | Jeffrey H. Tepper, age 53,54, has served as a director since February 2016. Mr. Tepper is Founder of JHT Advisors LLC, an M&A advisory and investment firm. From 1990 to 2013, Mr. Tepper served in a variety of senior management and operating roles at the investment bank Gleacher & Company, Inc. and its predecessors and affiliates (“Gleacher”). Mr. Tepper was Head of Investment Banking and a member of the Firm’s Management Committee. Mr. Tepper is also Gleacher’s former Chief Operating Officer overseeing operations, compliance, technology and financial reporting. In 2001, Mr. Tepper co-founded Gleacher’s asset management activities and served as President. Gleacher managed over $1 billion of institutional capital in the mezzanine capital and fund of hedge fund areas. Mr. Tepper served on the Investment Committees of Gleacher Mezzanine and Gleacher Fund Advisors. Between 1987 and 1990, Mr. Tepper was employed by Morgan Stanley & Co. as a financial analyst in the mergers & acquisitions and merchant banking departments. Mr. Tepper is currently a director of Alta Mesa Resources, Inc. (NASDAQ: AMR), a position he has held since March 2017 when the company was called Silver Run Acquisition Corporation II. Mr. Tepper received an MBAa Master of Business Administration from Columbia Business School and a B.S.Bachelor of Science in Economics from The Wharton School of the University of Pennsylvania with concentrations in finance and accounting. Mr. Tepper is experienced in mergers and acquisitions, corporate finance, leveraged finance and asset management. We believe Mr. Tepper is qualified to serve on our Board due to his significant investment and financial experience. | | 2016experience, particularly as it relates to mergers and acquisitions, corporate finance, leveraged finance and asset management. |

Tony R. WeberPierre F. Lapeyre, Jr.

(Series A Preferred)Class III)

| | Tony R. Weber,Pierre F. Lapeyre, Jr., age 56,57, has served as a director since October 2016. Mr. WeberLapeyre is a Founder of Riverstone Holdings, LLC, a private equity firm specializing in energy investments (together with its affiliates, “Riverstone”) and has been a Partner/Senior Managing Director since 2000. Prior to founding Riverstone, Mr. Lapeyre was a Managing Director of Goldman Sachs in its Global Energy and Power Group. Mr. Lapeyre joined Natural Gas PartnersGoldman Sachs in December 20031986 and spent his 14-year investment banking career focused on energy and power, particularly the midstream, upstream and energy service sectors. Mr. Lapeyre has served as a Managing Partnernon-executive board member of Riverstone Energy Limited (LSE: REL) (“REL”) since November 2013. He previously served Natural Gas Partners in other capacities, including Managing Director from 2007 to November 2013. Prior to joining Natural Gas Partners,May 2013 and serves on the boards of directors or equivalent bodies of a number of public and private Riverstone portfolio companies and their affiliates. Mr. Weber was the Chief Financial Officer of Merit Energy Company from April 1998 to December 2003. Prior to that, he was Senior Vice President and Manager of Union Bank of California’s Energy Division in Dallas, Texas from 1987 to 1998. Mr. Weber served as the Chairman of the Board for Memorial Resource Development, Inc. from its formation in January 2014 until Memorial Resource Development, Inc. was acquired by Range Resources Corporation in September 2016. In addition, Mr. Weber served asLapeyre is currently a director of Alta Mesa Resources, Inc. (NASDAQ: AMR), a position he has held since February 2018. He has a Master of Business Administration from the general partnerUniversity of Memorial Production Partners LP from December 2011 to March 2016North Carolina at Chapel Hill and a memberBachelor of the Board of Directors of WildHorse Resource Development Corporation from September 2016 to February 2019, when WildHorse Resource Development Corporation was acquired by Chesapeake Energy Corporation. Further, in his role at Natural Gas Partners, Mr. Weber serves on numerous private company boards as well as industry groups, including the IPAA Capital Markets Committee and Dallas Wildcat Committee. He currently serves on the Dean’s Council of the Mays Business School at Texas A&M University and was a founding member of the Mays Business Fellows Program. Mr. Weber received a B.B.A.Science in Finance in 1984and Economics from Texas A&M University. the University of Kentucky.

We believe Mr. WeberLapeyre is qualified to serve on our Board due to his extensive financing, mergers and acquisitions and investing experience in the energy and power industries. Mr. Lapeyre has a deep understanding of the energy and power industries arising from his experience as a Founder and Managing Director at Riverstone and prior experience at Goldman Sachs. Furthermore, as a result of Mr. Lapeyre’s service on the boards of various energy and power companies, he is able to share best practices relating to transactions, risk oversight, shareholder engagement, corporate finance, bankinggovernance, corporate responsibility and private equity experience. | | 2016management. |

|

| | |

| Director | | Age, Principal Occupation, Business Experience, Other Directorships Held and Director Qualifications |

David M. Leuschen (Class III)

| | David M. Leuschen, age 68, has served as a director since October 2016. Mr. Leuschen is a Founder of Riverstone and has been a Senior Managing Director since 2000. Prior to founding Riverstone, Mr. Leuschen was a Partner and Managing Director at Goldman Sachs and founder and head of the Goldman Sachs Global Energy and Power Group. Mr. Leuschen joined Goldman Sachs in 1977, became head of the Global Energy and Power Group in 1985, became a Partner of that firm in 1986 and remained with Goldman Sachs until leaving to found Riverstone in 2000. Mr. Leuschen also served as Chairman of the Goldman Sachs Energy Investment Committee, where he was responsible for screening potential investments by Goldman Sachs in the energy and power industries. Mr. Leuschen has served as a non-executive board member of REL since May 2013 and serves on the boards of directors or equivalent bodies of a number of private Riverstone portfolio companies and their affiliates. Mr. Leuschen is currently a director of Alta Mesa Resources, Inc. (NASDAQ: AMR), a position he has held since February 2018. Mr. Leuschen received a Master of Business Administration from Dartmouth’s Amos Tuck School of Business and a Bachelor of Arts from Dartmouth College.

As a founder of Riverstone, Mr. Leuschen has overseen investments in, and the operations of, various companies operating in the energy and power industries. In connection with that role and his prior experience at Goldman Sachs, Mr. Leuschen has a deep understanding of the energy and power industries and has extensive experience with capital markets and other financing transactions. Mr. Leuschen also serves as a director on the boards of various other energy and power companies, which we believe further enhances his understanding of the industry and perspective on best practices relating to corporate governance, corporate responsibility, management and capital markets transactions. For these reasons, among others, we believe Mr. Leuschen is qualified to serve as a director. |

| | |

Mark G. Papa (Class III)

| | Mark G. Papa, age 73, has served as our Chief Executive Officer and a director since November 2015. Effective May 31, 2020, Mr. Papa will be retiring from his roles as our Chief Executive Officer, Chairman of the Board and a member of the Board. For more information on the previously announced leadership transition, see “Corporate Governance—Leadership Transition” below.

Mr. Papa previously served as an advisor to Riverstone, a position he held from February 2015 through December 2019. Prior to joining Riverstone, Mr. Papa was retired from December 2013 through February 2015. Previously, Mr. Papa was Chairman and Chief Executive Officer of EOG, from August 1999 to December 2013. Mr. Papa served as a member of EOG’s board of directors from August 1999 until December 2014. Mr. Papa worked at EOG for 32 years in various management positions. Prior to joining EOG, Mr. Papa worked at Conoco Inc. for 13 years in various engineering and management positions. Mr. Papa has also served on, and acted as Chairman of, the board of directors of Schlumberger Limited (NYSE: SLB), an international oilfield services company, since October 2018 and August 2019, respectively. Since November 2006, Mr. Papa has served on the board of Casa de Esperanza, a non-profit organization serving children in crisis situations. Mr. Papa previously served on the board of directors of Oil States Industries (NYSE: OIS), an international oilfield services company, from February 2001 to August 2018. In February 2010 and 2013, the Harvard Business Review cited Mr. Papa as one of the 100 Best Performing CEOs in the World; both times Mr. Papa was the highest ranked Global Energy CEO. Additionally, Institutional Investor magazine repeatedly ranked him as the Top Independent E&P CEO. He received a Bachelor of Science in petroleum engineering from the University of Pittsburgh and a Master of Business Administration from the University of Houston.

We believe Mr. Papa’s significant experience in the energy industry and his deep understanding of the Company and its assets make him well qualified to serve as the Chairman of our Board. Through his current role as our Chief Executive Officer and Chairman, and his prior experience with EOG and other exploration and production companies, Mr. Papa has established himself in the industry as a proven leader with a strong understanding of macro conditions in the energy industry, exploration and production techniques, as well as the operational, strategic, financial, risk and compliance issues facing a publicly traded company in the upstream oil and gas industry.

|

CORPORATE GOVERNANCE

Governance Highlights

We are committed to corporate governance practices that promote the long-term interests of our stockholders, strengthen our Board, foster management accountability, and help build public trust in our company.Company. The table below sets forth some of our most important governance highlights, which are described in more detail in this proxy statement

Board Structure and Practices

|

| | | | | | |

| Size of Board of Directors | | 9 | | Annual Board and Committee Self-Evaluations | | Yes |

| Number of Independent Directors | | 5 | | Diverse Board Skills and Experience | | Yes |

| | | | | Lead Independent Director | | Yes |

Board and Committee Governance; Board’s Role in Risk Oversight

|

| | | | | | |

| Corporate Governance Guidelines | | Yes | | Review of Related Person Transactions | | Yes |

| Code of Business Conduct and Ethics | | Yes | | Compensation Risk Assessment | | Yes |

| Board and Audit Committee Risk Oversight | | Yes | | Majority Voting in Director Elections | | Yes |

Compensation; Stock Ownership

|

| | | | | | |

| Annual Equity Grants to Directors | | Yes | | Tax Gross-Ups | | No |

| Non-Hedging and Non-Pledging Policies | | Yes | | Director and Senior Management Stock Ownership Guidelines | | Yes |

| Clawback Policy | | Yes | | | | |

Our website (www.cdevinc.com) includes materials that are helpful in understanding our corporate governance practices, including our Corporate Governance Guidelines, Code of Business Conduct and Ethics, Policy for Related Person Transactions, Policy for Accounting-Related Complaints and charters for the committees of our Board.

Leadership Transition

On February 24, 2020, we announced that Mark G. Papa, our Chief Executive Officer and the Chairman of the Board, intends to retire, effective May 31, 2020. Mr. Papa has served as our Chief Executive Officer and the Chairman of the Board since October 2016 and has worked in the oil and gas industry for 52 years. The Board, upon the recommendation of the N&CG Committee, approved a succession plan, pursuant to which, as of June 1, 2020:

Sean R. Smith, our Chief Operating Officer, will succeed Mr. Papa as our Chief Executive Officer;

Mr. Smith will be added to our Board as a Class III director;

Steven J. Shapiro, an independent director on the Board, will succeed Mr. Papa as the Chairman of the Board; and

Matthew R. Garrison, our Vice President of Geosciences, will succeed Mr. Smith as our Chief Operating Officer.

Until June 1, 2020, Messrs. Papa, Smith, Shapiro and Garrison will continue to serve in their current roles.

Board Role in Risk Oversight

As an oil and gas exploration and production company, we encounter a variety of risks, including, among others, commodity price volatility and supply and demand risks, risks associated with rising costs of doing business, availability of capital and financing, risks associated with our development, acquisition and production activities, environmental and other regulatory risks, weather-related risks and political instability. While our senior management is responsible for the day-to-day management of the risks we face, the Board, directly and through its committees, oversees the Company’s management and, with their assistance, is actively involved in the oversight of risks that could affect the Company. Specifically, the Board is responsible for ensuring that the risk management processes designed and implemented by management are adequate to address the risks we face and function as intended. Accordingly, during the course of each year, the Board (i) reviews and approves management’s operating plans and considers any risks that could affect operating results, (ii) reviews the structure and operation of our various departments and functions and (iii) in connection with the review and approval of particular transactions and initiatives, reviews related risk analyses and mitigation plans.

The Board has delegated certain risk oversight responsibility to committees of the Board as follows: (i) the audit committeeAudit Committee of the Board (the “Audit Committee”) oversees the Company’s risk assessment and risk management guidelines, policies and processes, as well as risks relating to the financial statements and financial reporting processes of the Company, meeting periodically with management, our independent auditors and our independent petroleum reservoir engineering firm to discuss the Company’s major financial risk exposures and the steps management is taking to monitor and control such exposures, including the Company’s risk assessment and risk management policies; (ii) the compensation committeeCompensation Committee of the Board (the “Compensation Committee”) oversees risks related to compensation arrangements for the Company’s senior executivemanagement and other compensation;employees; and (iii) the nominating and corporate governance committee of the Board (the “Nominating and Corporate Governance Committee”)N&CG Committee oversees risks related to corporate governance.governance, including succession planning. Our senior management regularly reports to the full Board and, as appropriate, the committees of the Board regarding enterprise risk that the Company must mitigate and/or manage.

Board Independence

NASDAQ listing rules require that a majority of the board of directors of a company listed on NASDAQ be composed of “independent directors,” which is defined generally as a person other than an officer or employee of the company or its subsidiaries or any other individual having a relationship which, in the opinion of the company’s Board,board of directors, would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director. Our Board has determined that Maire A. Baldwin, Karl E. Bandtel, Matthew G. Hyde, Steven J. Shapiro and Jeffrey H. Tepper and Tony R. Weber are independent within the meaning of the NASDAQ listing rules. Further, our Board has determined that Maire A. Baldwin, Karl E. Bandtel, Steven J. Shapiro and Jeffrey H. Tepper, the current members of the Audit Committee, are independent with the meaning of Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Board Leadership Structure

Mark G. Papa currently serves as our Chief Executive Officer and the Chairman of the Board, and we have no policy with respect to the separation of the offices of Chairman and Chief Executive Officer. In connection with the retirement of Mr. Papa, the Board has decided to separate the Chairman and Chief Executive Officer roles. Beginning June 1, 2020, Mr. Smith will become our Chief Executive Officer, and Mr. Shapiro will become the Chairman of the Board. Our Board believes that separating these roles following Mr. Papa’s retirement will be the most effective leadership structure for the foreseeable future. The Board believes this leadership structure will permit the Chief Executive Officer to focus his attention on setting the Company’s strategic direction and managing our business while allowing the Chairman to function as an important liaison between management and the Board, enhancing the ability of the Board to provide oversight of the Company’s management and affairs.

Majority Vote in Director Elections

In early 2019, our Board proposed amendments to our governance documents to implement a majority voting standard in uncontested director elections, which were approved by our shareholders at the 2019 annual meeting of stockholders. As a result, election of the director nominees named in Proposal 1 requires that each director be elected by a majority of the votes cast, meaning that the number of shares voted “FOR” a nominee must exceed the number of shares voted “AGAINST” such nominee. We believe that this majority voting standard in uncontested director elections gives our stockholders a greater voice in determining the composition of our Board than the plurality voting standard used in prior director elections. For any director election where the number of director nominees exceeds the number of directors to be elected, a plurality voting standard continues to apply pursuant to our governance documents.

Our Corporate Governance Guidelines include a director resignation policy to address the issue of any “holdover” director who is not re-elected but remains a director because his or her successor has not been elected or appointed. This policy requires each incumbent director that is nominated by the Board for re-election to tender an irrevocable resignation letter to the Board prior to the mailing of the proxy statement for the meeting at which such nominee is to be re-elected as director. If such incumbent director is not re-elected by a majority vote in an uncontested election, the N&CG Committee will consider the tendered resignation and make a recommendation to the Board as to whether to accept or reject the resignation. The Board would then, after taking into account the recommendation of the N&CG Committee, accept or reject such tendered resignation generally within 90 days following certification of the election results. Thereafter, the Company would publicly disclose the decision of the Board and, if applicable, the Board’s reasons for rejecting a tendered resignation. If a director’s tendered resignation is rejected, such director would continue to serve until a successor is elected, or until such director’s earlier removal or death. If a director’s tendered resignation is accepted, then the Board could fill any resulting vacancy or decrease the number of directors.

Lead Independent Director

Our Corporate Governance Guidelines provide that, if the Chairman of the Board is a member of management or does not otherwise qualify as independent, the independent directors may elect a lead independent director.Lead Independent Director. In 2018, the independent directors elected Ms.Maire A. Baldwin to serve as the Board’s leadLead Independent Director, and Ms. Baldwin was re-elected for that role by the independent director.directors in 2019. The lead director’sLead Independent Director’s responsibilities include, but are not limited to: (i) presiding over all meetings of our Board at which the Chairman of the Board is not present, including any executive sessions of the independent directors; (ii) approving Board meeting schedules and agendas; and (iii) acting as the liaison between the independent directors and the Chief Executive Officer and Chairman of the Board. Our

In connection with the retirement of Mr. Papa, the Board may modify its leadership structure inhas decided to separate the futureChairman and Chief Executive Officer roles, effective as it deems appropriate.of June 1, 2020. Thereafter, Mr. Shapiro, an independent member of the Board, will serve as the Chairman of the Board, and a separate Lead Independent Director role will no longer apply.

Board Meetings